Sentiment Analysis

Catch next big trend for US markets using Heckyl Sentiment Index

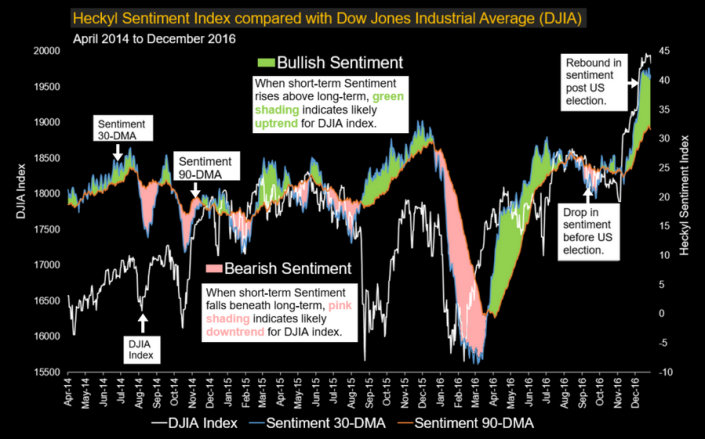

Traders and investors are always interested to know where the markets are heading. News, which is a big driver for the markets, can help such traders and investors. By keeping a tab on news flow, they can measure temperature of the market, identify patterns and form their strategies. However, vast amount of today’s information is making it increasingly difficult to monitor relevant news items and assess its positive/ negative impact on the market.

To address this problem, Heckyl has introduced Sentiment Index for Dow Jones Industrial Average (DJIA), a benchmark index for the 30 most significant companies in the US. Heckyl Sentiment index distills massive amounts of news data into a broad reading of collective sentiment for DJIA index. Traders and investors can use Heckyl Sentiment index as a directional signal to figure out whether they should go long or short on the US markets.

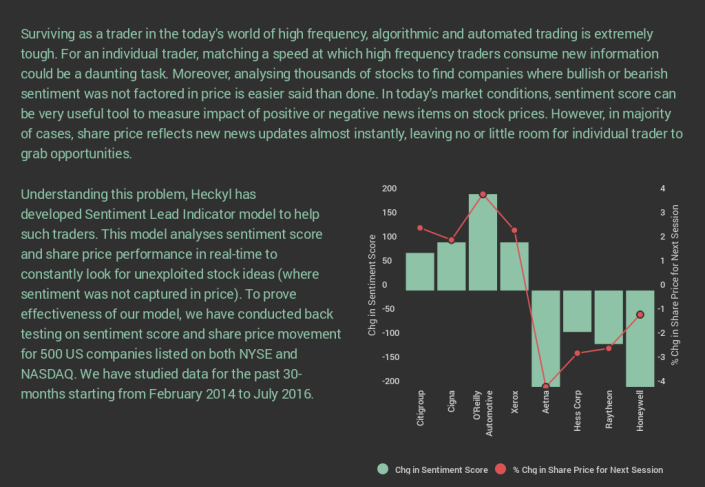

Predict impending stock move using Heckyl Sentiment Analytics

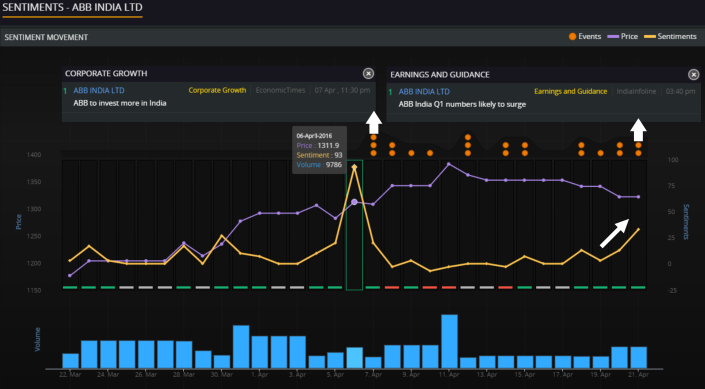

The age-old battle of between fundamental and technical analysis will always continue. Both methods of analyzing a stock are powerful and have their own strengths and weaknesses. However, in the stock market, prices are largely driven by the new information. The market participants assess the new information and analyse its potential positive or negative impact on the stock. Based on their perception of new information, they take buy or sell positions in the market.

- ← Previous

- 1

- …

- 6

- 7

- 8

- Next →