Get the power of Heckyl News Analytics for profitable trade

To succeed in today’s stock market, one must have access to new information that can move the markets higher or lower. At the same time, getting such price sensitive information in time is also important to stay ahead of others. In the last 10-years, we have seen massive explosion in the amount of information that is available on the internet. However, the huge amount of information is making it increasingly difficult for traders and investors to find price sensitive news in time.

To succeed in today’s stock market, one must have access to new information that can move the markets higher or lower. At the same time, getting such price sensitive information in time is also important to stay ahead of others. In the last 10-years, we have seen massive explosion in the amount of information that is available on the internet. However, the huge amount of information is making it increasingly difficult for traders and investors to find price sensitive news in time.

In this scenario, if you have a system to swiftly mine the big data and filter noise from information, then you can find and exploit opportunities. Previously, such intelligent systems were mainly available to large institutions and big investors.

Even today, they are the first one to react on any news item. On the other hand, lack of access to such system puts most of the retail traders and investors at a disadvantage. In most cases, they are the last person to react on new updates in the market. As a consequence, they are losing out on new opportunities to trade.

Business newspapers and channels, financial portals and exchange websites are good sources of information. These sources provide a lot of valuable information, but most of it is not bundle to specific requirement of traders and investors.

Last week, business newspapers were busy in covering war of words between the finance minister and the RBI governor on the India’s growth prospects. For the markets, it was least important news. Because the India story hasn’t changed during the last 2-years. Earnings remained dismal, while Sensex is moving in a band. Reduction in interest rates by 150 bps and Modi government’s reforms drive are also not yielding the desired results.

Another such example is stock exchanges. They received hundreds of corporate announcements, which are release on exchange website in real time. Only handful of these announcements are price sensitive. Let’s have a look at some of the announcements that appeared on April 21 below:

UNIWORTH SECURITIES LTD. – 512408 – Statement of Investor Complaint under Reg. 13(3) of SEBI (LODR) Regulations, 2015 for Quarter ended March 31, 2016

TATA CONSULTANCY SERVICES LTD. – 532540 – TCS recognised as one of The Times Top 50 Employers for Women in the UK

Are these announcements price sensitive? Can you trade based on it? Of course not. Similarly, most of the news available on the financial portals are either delayed or not grouped properly for the needs of traders and investors. Moreover, not all can have access to business news channels during the market hours.

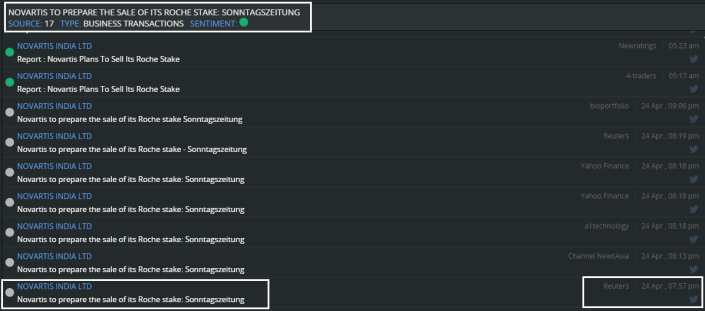

To explain it better, we have taken a case of Novartis India, a subsidiary of Swiss pharma giant, Novartis AG. Swiss newspaper Sonntagszeitung reported on Sunday, April 24, that Novartis AG is planning to sell a 13.5 billion Swiss franc ($13.8 billion) stake in its local rival Roche.

Reuters picked up the news item from the Swiss newspaper and reported it on their global business edition around 8 pm (IST) on April 24. The news was not noticed by the market participants till noon on Monday, April 25. It was noticed only after Novartis AG opened up half a percent higher. After that, shares of Novartis India have also started moving higher in the post noon session. Later, the same news item was featured in Reuters India edition. Finally, Novartis India settled at Rs 764.75 a share, up 3.77 percent from previous close of Rs 737 a share.

If you had prior knowledge about this news item, then you had the opportunity to earn intra-day profit of about Rs 25 per share by buying the stock around Rs 740 in the morning and then selling it around Rs 765 in the post noon session.

Understanding such difficulties in accessing the price sensitive news, Heckyl launched FIND News Analytics platform in 2012 to help the traders and investors. News analytics platform provides market moving alerts along with news sentiments in the real time basis.

In case of Novartis India, Heckyl’s platform issued alert for news item on Novartis AG’s plan to sell stake in Roche at 7.57 pm on Sunday, April 24. Heckyl’s alert has provided user enough time to react on the news in the first half of Monday, April 25. (You can read more about product features in our previous blog, ‘News Analytics in Real-Time’.)

Below image shows the list of news alerts issued by FIND platform:

Share price chart for Novartis India on April 25:

Bottom Line:

Having latest technology that provides market moving information is the need of the hour. One can not only survive in today’s market but can also make profit by tracking price sensitive news around the stock in real time.

Heckyl, being at the forefront of technology innovation in financial space, is striving hard to empower retail traders and investors with better access to valuable information for profitable trade.

To know more, mail us at info@heckyl.com