FiND Sentiment Indicator turns bearish 4-days prior to DJIA crash on October 10

The Dow Jones Industrial Average (DJIA) index witnessed a significant fall in the past week amid concerns over a surge in bond yields and trade war between the US and China. In our view, news sentiment based strategy can help investors to predict an impending movement in the market.

Heckyl has developed FiND Sentiment Indicator which reflects the underlying sentiment of news coverage on the companies within the index. The moving average strategy based on FiND Sentiment Indicator signals the potential impact of the news sentiment on the value of the underlying index.

For instance, FiND Sentiment Indicator turned bearish 4-days prior to the 832 points crash in the DJIA index on October 10 (Image 1). Our system analyzed 1,01,066 news items for 30 companies within the DJIA index for the past 6-months. Out the total, 74,780 news items were positive, while 26,286 news items were negative.

[Image 1: Bullish/ Bearish Signals defined by Sentiment Indicator Strategy vs. DJIA] Read the rest of this entry »

Air India continues to lead news share of voice for 2nd quarter

India’s national carrier Air India led the news share of voice (SoV) among major airlines for the second quarter in a row. On the other hand, the news SoV for Interglobe Aviation remained at the second position in the June 2018 quarter. Meanwhile, Jet Airways and SpiceJet’s news SoV for the quarter stood at third and fourth positions respectively.

[Image 1: Top 4 airlines’ web news share of voice]

Read the rest of this entry »

Sun Pharma’s positive news volume jumps in Q1 to highest level in past 4-quarters

Sun Pharmaceutical Industries witnessed a significant improvement in the positive media coverage during the June 2018 quarter. Regulatory approvals and encouraging earnings led the positive news coverage for Sun Pharma in the June 2018 quarter.

At the same time, the volume of negative news has also dropped sharply in the same period. As a result, the long-term news sentiment has improved towards the end of the quarter.

Moreover, the improvement in news sentiment was also reflected in the recent rally in Sun Pharma’s stock price. Net-net, the news cycle was favorable for India’s leading drug maker in the June 2018 quarter.

[Compare screen: Sun Pharma – Share Price, News Volume, and Sentiment]

Bharti Airtel gets more aggressive with new product launches: FiND media study

Telecom operator Bharti Airtel has accelerated the pace of new product launches in the past 3-months to fight competition from rivals like Reliance Jio, Vodafone, and Idea.

FiND media coverage study showed that Bharti Airtel topped the product launch related news flow among major telecos consistently for the past 3-months. Moreover, the product launch related news updates from India’s largest telecom operator for the current quarter touched the highest level in the past 4-quarters.

[Image 1: Monthly product launch news volume for the leading telecos]

Our analysis showed that Bharti Airtel has ramped up new product launches significantly following the launched of postpaid plan by Reliance Jio on May 10. India’s largest telecom operator has launched new prepaid plans; various data and unlimited calling offers; affordable 4G smartphones; and Apple Watch 3 LTE during the past month. As a result, Bharti Airtel’s product launch news volume touched a multi-year high in May 2018.

[Image 2: Daily product launch news volume for Bharti Airtel and Reliance Jio] Read the rest of this entry »

Does significant change in correlation between US and SG yields indicate an opportunity?

The discovery and real-time monitoring of macroeconomic data are the two key gaps that the financial researchers face. To bridge this gap, Heckyl has introduced a unique Macroeconomic Data Analytics product.

Historically, Singapore and the US 10-year bond yields have witnessed strong positive correlation. However, the recent rally in US 10-year bond yield above 2.9% (given better-than-expected jobs data) has changed historical correlation with Singapore 10-year bond yield. In fact, this correlation has turned negative in the past 7 days.

(Correlation as on Jun. 6, 2018)

Given the mean-reverting nature of yields, does this signify an opportunity to trade in the fixed income market?

To know more about our Macroeconomic Data Analytics platform, email us at info@heckyl.com

IndiGo most affected airline by disruption in flight services: FiND media study

An analysis of media coverage on the leading air carriers in India has shown that Interglobe Aviation was the most affected airline by the disruption in flight services during the past 5-months.

Interglobe Aviation, the operator of IndiGo Airlines has dominated disruption related news flow among major Indian airlines in the past 5-months. It was followed by Air India and Jet Airways. On the other hand, SpiceJet attracted fewer news items related to disruption.

[Image 1: Compare news volume by sentiment and/ or category]

Technical issues, engine failure (A320 Neo planes), and flight delays & cancellations have disrupted operations of IndiGo Airlines during the past 5-months. Read the rest of this entry »

FiND Sentiment-based Strategy beats STI companies’ 1-year stock returns

Heckyl has developed FiND sentiment moving average (MA) strategy for measuring the potential impact of the positive/ negative news flow on the value of equities in real-time. The sentiment MA strategy indicates bullish/bearish signals based on the crossover of fast and slow moving averages of the company’s daily sentiment score.

We back-tested our sentiment MA strategy on 27 companies (excl. banks) from Straits Times index (STI). Our back-testing has proved the potential of sentiment MA strategy to beat STI companies’ stock price performance.

If an investor/a trader was to buy/sell STI stocks as per the bullish/bearish signal and hold the position for the period till the signal reverses, then an equal investment in 27 STI stocks could have yielded 6.3% return over the past 1-year (as against 0.3% price return).

[Image 1: Investment performance based on sentiment signal and stock performance]

Read the rest of this entry »

These 3 drugmakers’ news sentiment consistently remains below industry average

FiND study showed that the news sentiment for 3 drug-makers from top 25 pharma companies consistently remained below the industry average for the past 12-months. FDC, Sun Pharma Advanced Research and Caplin Point Laboratories were 3 companies whose short-term, medium-term and long-term news sentiment consistently stayed below the industry average for the past 12-months.

In our view, below industry average news sentiment for a prolonged period of time does not augur well for the company. Corporate communications team can step up media engagement at the appropriate time by picking up early signals for deteriorating news coverage.

[Image 1: Short-term news sentiment (50-DMA)] Read the rest of this entry »

Maruti Suzuki tops product launch news share of voice helped by Brezza, Ertiga

Maruti Suzuki topped the share of voice for product launch news coverage among the leading automakers in the past 30-days. At the same time, India’s largest passenger car manufacturer has also led the share of voice for web news coverage during the same period.

[Image 1: Web News Share of Voice]

The media frenzy around new car launches helped Maruti to lead the share of voice for the product launch news. Brezza and Ertiga dominated the product launch related news flow for Maruti in the past 30-days.

[Image 2: News Mentions for Maruti’s Car Models] Read the rest of this entry »

IPCA Laboratories losing market share in anti-malarial products

Indian pharma market for anti-malarial products has shown declining trend over the last five years. Ipca, a leading player in anti-malarial products in India has also seen a downtrend in sales of these drugs. However, the trend in de-growth has been sharper in the industry when compared with a decline in IPCA’s revenue from anti-malaria products.

[Image 1: Compare screen shows anti-malarial products sales for the industry and IPCA]

[Image 2: Compare screen shows index for anti-malarial products sales for the industry and IPCA]

IPCA derives over 16% of revenues from anti-malaria products (Image 3). The company has maintained its position as a market leader in the domestic market for anti-malarial products with the share of ~50%. However, in recent months, IPCA’s market share has started dwindling marginally (Image 4).

Anti-malarial products account for 0.44% of the Indian pharma market while the average market share of the companies in this segment is pegged at 0.67%, which is fairly constant.

[Image 3: Therapeutic revenue contribution for IPCA]

[Image 4: Therapeutic market share for IPCA]

[Image 4: Therapeutic market share for IPCA]

FiND collects, organizes and performs deep-dive analytics on structured and unstructured data sets to provide unique insights into companies, industries, and countries. Some of the key data sets that we offer for Pharmaceutical sector are litigation, new drug opportunity, detailed drug profile and clinical trial data from multiple locations.

To know more about FiND, email us at find@heckyl.com

Singapore Inc’s growth news flow hits 2-year high in Apr’18

News flow related to growth-oriented business activities of Singapore firms touched the highest level in 2-years in April 2018, according to a study conducted by Heckyl, a leading Fintech engaged in news and financial data analytics. A surge in growth-oriented news flow signals improvement in the business confidence among companies listed in Singapore.

M&A, partnerships, product launch, contracts, and expansion were top 5 categories leading growth news flow for Singapore listed companies in April 2018. At the company level, Singapore Airlines Ltd, IHH Healthcare Bhd, and Comfortdelgro Corp Ltd led the growth news flow during April 2018.

Heckyl has a clear focus on reduction of the information arbitrage by “discovery and analysis” of the news flow in real time. Heckyl’s FiND News and Sentiment Analytics product analyses news + data from thousands of sources (including social media) in real time. Our proprietary tagging algorithm can tag a specific news category to any news based on the keywords in that news item.

[Image 1: Search by Tags screen for Singapore] Read the rest of this entry »

[Image 1: Search by Tags screen for Singapore] Read the rest of this entry »

Negative news flow outpaces positive coverage for these 5 companies

Negative news flow has outpaced positive coverage for 20 companies from BSE 200 index during April 2018, FiND media study showed. ICICI Bank, Wipro, Idea Cellular, IDBI Bank and Suzlon were top 5 companies receiving extremely negative media coverage in April 2018.

[Image 1: Positive to Negative News Ratio (The ratio value above 1 indicates mostly positive media coverage. On the other hand, the ratio value below 1 signals broadly negative media coverage.)] Read the rest of this entry »

[Image 1: Positive to Negative News Ratio (The ratio value above 1 indicates mostly positive media coverage. On the other hand, the ratio value below 1 signals broadly negative media coverage.)] Read the rest of this entry »

Did you miss the recent rally in crude oil?

April 2018 turned out to be a favorable month for crude oil prices. Rising geopolitical tensions in Syria and the Middle East coupled with higher demand and lower inventories aided a 5.6% rally in the crude oil prices in the past month. Moreover, the expectations of amicable resolution on trade war between the United States and China also supported a rise in crude oil prices.

FiND, alternative data platform has captured the key news items which supported rally in crude oil. At the same time, Heckyl platform has accurately captured underlying positive news sentiment around crude oil (Image 1).

[Image 1: Crude Oil News Flow during April 2018] Read the rest of this entry »

Toyota Yaris Launch in India: Honda City likely to lose more

Toyota Yaris’s launch with an aggressive pricing will surely disturb the status quo in Mid-size Sedan segment in India.

In this study, we will be analyzing who will be getting impacted most by Toyota’s new arrival. We will be taking top 3 players from mid-size sedan segment as these names occupy close to 85% market share in a relatively less crowded segment. The top 3 models include Honda City, Maruti Suzuki Ciaz, and Hyundai Verna.

Honda City is by far the largest selling model of Honda in India, constituting 31% of company’s total sales (1Q-18). Hyundai Verna, launched in 3Q-17, has been the largest gainer in the segment. Its market share has picked to 29% in 1Q-18 from 6% in 1Q-17. Unlike Honda’s City, Hyundai’s reliance on the model is much less and Verna constituted just 9% of Hyundai’s total sales in India in 1Q-18.

Maruti Suzuki’s Ciaz was launched in 4Q-14. Given MSIL’s diverse small car portfolio, its reliance on Ciaz is minimal. We believe that any disruption by a new arrival will have little impact on it. A Ciaz facelift is also expected in August this year and this should help the model in capturing some lost ground. Ciaz’s market stood at 32% in Mid-size sedan segment in 1Q-18, down 560 bps vs. 1Q-17.

[Compare screen: PV Unit sales for top 3 models]

Given Honda’s reliance on City and time gap from now for its next-generation launch (2020), we suspect City to be the most vulnerable of the lot from Yaris aggressive launch. We understand that City has a loyal customer base. However, recent onslaught of the launches dented its market share.

Heckyl’s alternative data platform, FiND collects and organizes macro, micro, and financial data to provide unique insights into automobile sector.

To know more about FiND, email us at info@heckyl.com

India Commercial Vehicle sector on a strong growth path

Low base likely to push growth further in coming months

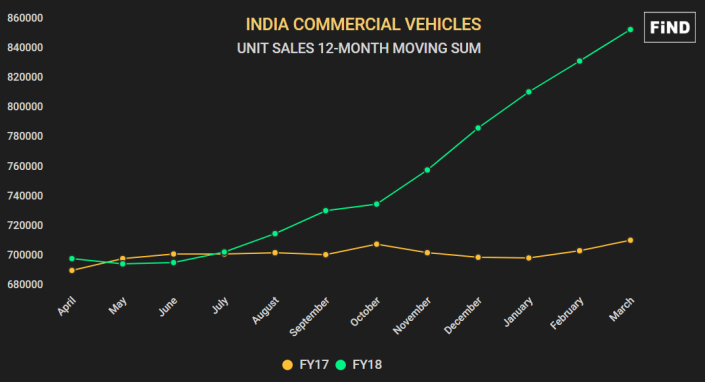

The Commercial Vehicle (CV) sector, which is considered to be the barometer of an economy, recorded a surge of 19.9% in unit sales during FY18. The remarkable feature of this growth has been recovery post GST implementation (Image 1). Overall sales of CVs increased by 34% and 31% respectively in Q4CY17 and Q1CY18 after a decline of 9% in Q2CY17.

[Image 1: India CV quarterly unit sales and y-o-y change]

[Image 1: India CV quarterly unit sales and y-o-y change]

At the same time, the 12-month moving sum of CV sales witnessed sharp northwards movement post July-17 (Image 2). We assign this surge to fleet owners’ bulk buying post GST implementation. Moreover, this trend is expected to continue in coming months given improved macro-conditions at ground level, huge pent-up demand, the higher average age of the fleet and lower comparable (Q2CY17 was down 9% y-o-y).

[Image 2: India CV unit sales 12-month moving sum] Read the rest of this entry »

[Image 2: India CV unit sales 12-month moving sum] Read the rest of this entry »

These 3 companies witness drop in long-term news sentiment to 2-year low

FiND media coverage study for BSE 100 index companies showed a significant deterioration in the long-term news sentiment for Glenmark Pharmaceuticals, Vakrangee and fraud-hit Punjab National Bank (PNB).

These 3 companies have been receiving negative press coverage for quite some time. As a result, news sentiment 200-day moving average (DMA) for these 3 companies dipped to a 2-year low on Apr. 17, 2018.

[Image 1: Compare screen shows Sentiment 200-DMA] Read the rest of this entry »

[Image 1: Compare screen shows Sentiment 200-DMA] Read the rest of this entry »

FiND News Sentiment strategy beats the stock market

With a clear focus on reduction of the information arbitrage, Heckyl has developed a strategy based on FiND News Sentiment Indicator for identifying bullish/ bearish patterns for the benchmark index, sector as well as individual stocks.

FiND News Sentiment Indicator reflects the underlying sentiment of news coverage on the companies. The strategy based on this indicator signals the potential impact of the news sentiment on the value of underlying index or stock.

We have constructed our strategy by taking moving averages of FiND News Sentiment Indicator. Our system generates bullish/ bearish signals based on the crossover of shorter-term (20-days) and longer-term (60-days) moving averages of FiND News Sentiment Indicator.

Bullish: When short-term 20-DMA of FiND News Sentiment Indicator is above long-term 60-DMA, underlying index or stock tends to rise. It reflects an improvement in news sentiment in recent time when compared with the past 2-months.

Bearish: When short-term 20-DMA of FiND News Sentiment Indicator is below long-term 60-DMA, underlying index or stock tends to fall. It shows a deterioration in news sentiment in recent time when compared with the past 2-months.

For simplicity, we have defined sentiment intensity as a difference between 20-DMA and 60-DMA of FiND News Sentiment Indicator to showcase bullish and bearish phases.

When the value of sentiment intensity is above 0 (20-DMA > 60-DMA), then it is a sign of bullish trend ahead. On the other hand, fall in sentiment intensity value below 0 level (20-DMA < 60-DMA) reflects bearish trend ahead.

Our back-testing proved the application of FiND News Sentiment Strategy for trading/ investment in the market. FiND News Sentiment strategy has outperformed benchmark index, sector and stock returns across time periods.

Here, we are presenting the case study on the Nifty index, Nifty Pharma and Sun Pharma to showcase how bullish/bearish signals defined by News Sentiment Strategy can help trader/ investor for beating the index/ stock returns.

NIFTY INDEX

We analyzed over 1.56 lakh news items for 50 companies within the Nifty index for the past 3-years. Out the total, 1,19,162 news items were positive, while 37,175 news items were negative.

As can be seen in below chart (Image 1), bullish/bearish signals based on news sentiment strategy can give an early indication of upward/downward movement for the 50-share index.

[Image 1: Nifty Index and Bullish/ Bearish Period defined by Sentiment Intensity]

[Image 1: Nifty Index and Bullish/ Bearish Period defined by Sentiment Intensity]

If a trader/ investor was to buy/sell Nifty as per the bullish/bearish signal and hold the position for the period till the signal reverses versus an investment in Nifty, the returns would be significantly higher.

[Image 2: Returns based on Sentiment Signal and Nifty Index performance] Read the rest of this entry »

[Image 2: Returns based on Sentiment Signal and Nifty Index performance] Read the rest of this entry »

Japan Airlines delivers industry-beating on-time performance; Air India consistently lags on punctuality

The on-time performance (OTP) is one of the most important performance indicators for airlines. It shows how frequently the airline has managed to operate flights within the declared scheduled time.

OTP is a measure of service quality/ punctuality. The higher OTP can help airlines to meet its customer expectations. At the same time, improvement in customer service can also boost airline’s profitability.

Over the past 24-months, OTP for Japan Airlines has consistently outperformed the industry average. On the other hand, OTP for state-run Air India has consistently remained below the industry average in the last 24-months except April 2017.

Heckyl’s alternative data platform FiND collects and organizes macro, micro, and financial data to provide unique insights into aviation sector.

To know more about FiND, email us at find@heckyl.com

M&M races ahead of Maruti, Tata Motors with a surge in news sentiment to 5-yr high

Mahindra & Mahindra (M&M), one of the leading automobile companies in India, witnessed a surge in news sentiment to a 5-year high helped by extremely positive media coverage in March 2018. A slew of new product launches by M&M over the past 1-month lifted news sentiment to the highest level in the past 5-years.

With buoyant media coverage, M&M has surpassed news sentiment of both Maruti Suzuki and Tata Motors in March 2018 for the first time in the last 16-months.

[Image 1: Compare screen highlights news sentiment 100-DMA]

[Image 1: Compare screen highlights news sentiment 100-DMA]

A series of positive news items highlighting new product launches, alternative energy and partnerships during the past 1-month pushed M&M’s news sentiment 100-day moving average (DMA) to 84.11 on Apr. 7, 2018. Read the rest of this entry »

Track clinical trials in FiND Calendar to spot new opportunities in pharma sector

With a clear focus on reduction of the information arbitrage, Heckyl has built an alternative data platform FiND which collects and organizes macro, micro, and financial data to provide unique insights into pharmaceutical sector.

In our view, trading opportunities can be spotted in the stock market by discovery and analysis of vast amount of alternative data available on the web. One such data set is clinical trial study results for pharmaceutical companies.

Clinical trials are research studies that explore whether a drug or device is safe and effective for humans. The pharmaceutical products go through three phases of clinical trials followed by a regulatory approval process. After completing all three phases and the approval process, the company can start monetizing the drug or device.

The drugmakers report the progress of ongoing clinical trials for each phase from time to time. The result of late study trials (phase 2 and 3) can provide the best idea about a drug’s chances of approval. A favorable result of late study trials can be seen as positive by the market and vice-versa.

To help traders/ investors, we have introduced Calendar which tracks release dates for clinical trial, drug approval, patent expiry, operating stats and industry events.

We present a case study on Clearside Biomedical, Inc., a late-stage biopharmaceutical company developing drug therapies to treat back-of-the-eye diseases.

On Mar. 5, 2018, Clearside announced positive topline results from its pivotal Phase 3 clinical trial of suprachoroidal CLS-TA in patients with macular edema associated with non-infectious uveitis (Image 1).

(Image 1: News screen for Clearside) Read the rest of this entry »

News mentions for Chanda Kochhar surge amid Videocon loan controversy

Chanda Kochhar, managing director and chief executive officer, ICICI Bank, has been in the news lately after a controversy erupted over a conflict of interest in loan approved to the Videocon Group. There were reports in the media that Chanda Kochhar allegedly favored Videocon Group while granting Rs 3,250 crore loan.

However, ICICI Bank board termed the allegations as “malicious and unfounded” against its MD and CEO and reposed faith and confidence in Chanda Kochhar.

As the name of Chanda Kochhar cropped up in the Videocon loan controversy, news mentions for ICICI Bank chief surged towards the end of March.

Analyzing Tesla’s recent downfall through an innovative lens

FiND News Analytics and Litigation product tracks and analyses news + legal cases from thousands of data sources in real time. We have a clear focus on reduction of the information arbitrage by “discovery and analysis” of the news flow and legal cases in real time.

Of late, Tesla stocks have tumbled by quite. The stock price downfall coincided with negative news coverage. A review of company media coverage shows that most of the negative news items were related to Legal, Recalls, and Bankruptcy.

Insight from FiND: Did you MISS the recent opportunity to short Facebook?

FiND, an alternative data platform, analyses news + data from thousands of sources (including social media) in real time. We have a clear focus on reduction of the information arbitrage by “discovery and analysis” of the news flow in real time. Our proprietary Sentiment Engine analyzes news by applying NLP and various business rules to capture underlying sentiment (positive/ negative/ neutral) accurately.

Earlier this week, the shares of Facebook were beaten down at the Wall Street due to a privacy failure by the social media giant. It’s surfaced that Cambridge Analytica improperly used the data of 50 million Facebook users to manipulate voters in US Presidential Election 2016.

News reports highlighting concerns over privacy of FB users’ data and misuse of social network platform have been making the rounds across mainstream media for months now. The negative media coverage highlighting these concerns gathered momentum during this month. However, the stock corrected sharply only after the media reported the misuse of FB users data by Cambridge Analytica. We highlight some of the news items captured by FiND below:

[Image 1: Company News Screen for FB] Read the rest of this entry »

Geneva Motor Show 2018: EVs steal the show; Volkswagen, Tata Motors lead product launch news coverage

Geneva Motor Show 2018 turned to be one of the most successful shows in recent years. Now that it has come to an end, we at Heckyl believe that success of the OEMs in showcasing new products/launches can be measured by the amount of media coverage they have received.

One clear message, visible from the attention given by Press and the OEMs, was that Electric Vehicles are arriving earlier than expected. See below our Buzzwords compilation for passenger vehicle industry from last one month’s new flow (Image 1).

[Image 1: Buzzwords for Auto Industry]

At OEMs level, auto behemoth Volkswagen is back in the news for all the good reasons. A surprise inclusion in the list was that of Tata Motors whose news coverage came close 4th, almost in line with Toyota Motor but ahead of i-series manufacture BMW. We believe that this jump in news for Tata Motors can be attributed to the launch of Jaguar’s all-electric I-PACE at Geneva.

This assumption is further strengthened by the fact that in Product launch category (yes, you can search and analyze news by categories in FiND, Heckyl’s News and Data Terminal!), Tata Motors jumped to the second position in last one month’s news coverage (Image 2).

[Image 2: Share of Voice] Read the rest of this entry »

Dilip Buildcon media sentiment strongest among its peers in Feb’18

Highway developer Dilip Buildcon received extremely positive media coverage during the past 1-month. Buoyant media coverage lifted Dilip Buildcon’s news sentiment (50-day moving average DMA) to the highest level in the past 1-year on Feb. 23, 2018.

We highlight media coverage trends for Dilip Buildcon below:

#1. At 43, Dilip Buildcon’s news sentiment 50-DMA was the highest among its peers. On the other hand, news sentiment 50-DMA for Sadbhav Infrastructure Project was the lowest among highway developers.

Tesla Model S outsells German rivals in Europe for first time in 4 years

2017 was the first year when Tesla’s Model S outsold its German rivals in the luxury sedan segment in Europe. Model S was launched in Europe in 2013, the same year as Mercedes S-Class and has been the main rival of S-class till 2016 before outpacing it in 2017 (Image 1).

Globally, Model S remains Tesla’s best-selling model and constituted more than half (53%) of the global deliveries in FY17.

[Image 1: Luxury sedan annual retail sales in Europe for top 4 players]

[Image 1: Luxury sedan annual retail sales in Europe for top 4 players]

Model S retail sales grew at a staggering 38.6% in 2017. On the other hand, BMW 7-Series and Mercedes S-Class recorded a drop of 13.4% and 1.4% respectively in 2017. Meanwhile, Audi A-8 reported a modest growth of 9.6% in 2017. Read the rest of this entry »

[Image 1: Share of Voice (as on Apr. 26, 2018)]

[Image 1: Share of Voice (as on Apr. 26, 2018)] [Image 2: Compare screen – News sentiment 100-DMA chart]

[Image 2: Compare screen – News sentiment 100-DMA chart]